Cryptocurrency mining represents digital prospecting where powerful computers compete to solve cryptographic puzzles, validating transactions and securing blockchain networks. Miners basically function as decentralized accountants, receiving newly minted coins and transaction fees as compensation for their computational labor and electricity expenditure. The process requires specialized hardware (ASICs or high-end GPUs) and increasingly demands industrial-scale operations as difficulty algorithms adjust to maintain consistent block times. The economics have evolved dramatically since Bitcoin’s early days—what once yielded fortunes on laptop processors now requires strategic positioning near cheap electricity sources.

Cryptocurrency mining—that peculiar junction where advanced cryptography meets electricity bills of staggering proportions—forms the backbone of blockchain networks worldwide.

The process represents a remarkable feat of computational labor wherein participants (miners) compete to solve complex cryptographic puzzles, effectively validating transactions and adding new blocks to the distributed ledger.

This validation mechanism guarantees integrity within decentralized systems while simultaneously introducing new coins into circulation—a rather elegant solution to both security and monetary policy.

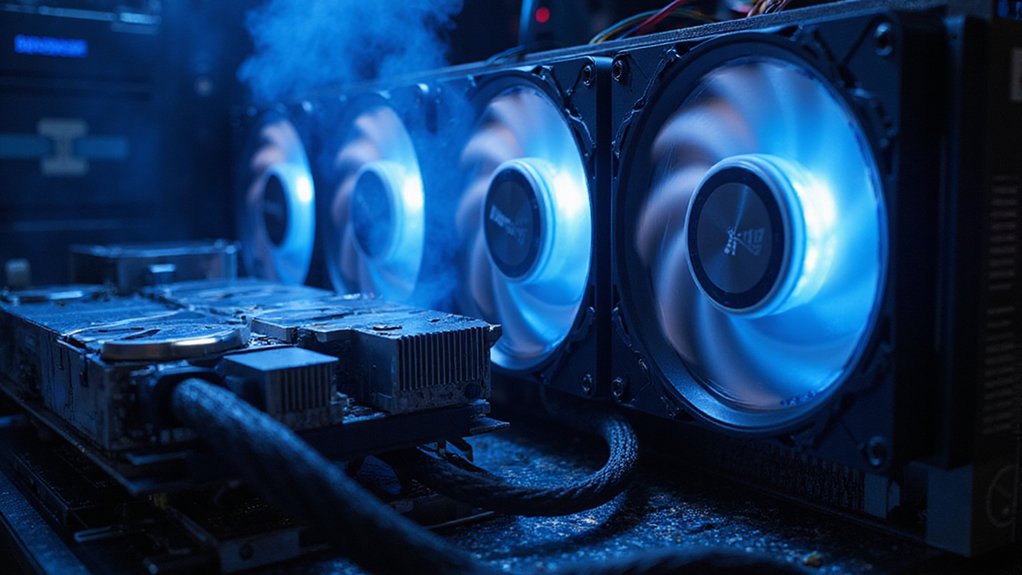

The mechanics behind mining involve an intricate dance of hardware, software, and pure mathematical chance.

Mining orchestrates a complex choreography where silicon, code, and probability perform their cryptographic ballet.

Miners deploy specialized equipment—typically high-powered GPUs or purpose-built ASICs—to generate hash values repeatedly until one satisfies the network’s difficulty parameters.

This computational lottery determines which miner earns the right to append the next block and claim the accompanying reward, a sum comprising newly minted coins plus transaction fees from users anxious to see their transfers processed.

As mining difficulty increases (an algorithmic adjustment guaranteeing consistent block times despite fluctuating network hash power), individual miners frequently coalesce into mining pools to improve their statistical chances of success.

These collaborative ventures distribute rewards proportionally to contributed computational power, offering predictable, if reduced, returns rather than the all-or-nothing proposition of solo mining¹.

The economics of mining present a fascinating study in diminishing returns.

While early adopters enjoyed substantial profits with minimal investment, today’s miners confront escalating hardware costs, relentless electricity consumption, and periodic halving events that systematically reduce block rewards.

This evolutionary pressure has transformed mining from a hobbyist pursuit into an industrial-scale operation concentrated in regions with favorable energy costs.

Environmental considerations have cast a shadow over mining operations, particularly for proof-of-work cryptocurrencies requiring enormous energy expenditure.

This tension between securing financial networks and minimizing ecological impact represents perhaps the most significant challenge facing cryptocurrency mining‘s long-term sustainability—a conundrum that continues to inspire technological innovation and heated debate throughout the industry.

In cryptocurrencies like Bitcoin, miners search for a specific value called a nonce value that, when hashed, produces an output meeting the network’s difficulty criteria.

Mining plays a vital role in adding new blocks to validate transactions while simultaneously minting new digital tokens as rewards.

Successful mining typically requires generating a 64-digit hexadecimal number that falls below the network’s target hash, often demanding trillions of attempts before finding a valid solution.

¹Though pool operators typically extract a small fee for their services.

Frequently Asked Questions

Is Cryptocurrency Mining Legal in All Countries?

Cryptocurrency mining’s legality exhibits remarkable global variation—a regulatory patchwork reflecting divergent national priorities.

While developed economies like the U.S. and EU members generally permit mining (albeit with increasing regulatory guardrails), numerous jurisdictions have implemented outright bans.

China’s prohibition stands as the most notable example, with several African and Middle Eastern nations following suit.

The legal status frequently hinges on concerns about energy consumption, financial stability, and illicit finance—considerations that continue to evolve alongside the technology itself.

How Much Electricity Does Mining Typically Consume?

Cryptocurrency mining consumes substantial electricity—between 0.6% and 2.3% of total U.S. power usage.

With identified U.S. facilities possessing maximum capacity of approximately 10,275 MW, annual consumption reaches an estimated 70 TWh at 80% utilization.

Bitcoin’s energy appetite reached historic highs in early 2022, a fact that (unsurprisingly) has attracted regulatory scrutiny.

This voracious consumption varies considerably with market conditions, creating unpredictable demand patterns that occasionally strain local power grids during peak usage periods.

Can I Mine Effectively Using a Laptop?

Laptop mining presents a curious dilemma—technically feasible yet practically inadvisable.

While one can mine Monero or other CPU-friendly cryptocurrencies on a laptop, the confluence of hardware limitations (inadequate cooling systems, underpowered GPUs) and economic realities (minimal hash rates yielding negligible returns) renders the endeavor largely quixotic.

The inevitable thermal throttling and potential hardware damage further undermine profitability.

For the curious neophyte, laptops might serve as educational tools, but serious miners invariably graduate to purpose-built rigs or ASICs.

What Happens to Mining After All Coins Are Mined?

After all bitcoins are mined (projected around 2140), the ecosystem undergoes a fundamental shift.

Miners will subsist entirely on transaction fees rather than block rewards, potentially altering network economics dramatically.

Security maintenance continues through the validation process, though profitability concerns—barring significant price appreciation—may precipitate industry consolidation.

Some operators will inevitably pivot to alternative cryptocurrencies, while others will double down on technological innovations and renewable energy solutions to preserve margins in this fee-only paradigm.

Are Some Cryptocurrencies Easier to Mine Than Others?

Yes, cryptocurrencies vary greatly in mining difficulty.

Monero, with its CPU-friendly RandomX algorithm, offers a gentler entry point for novices than Bitcoin’s ASIC-dominated landscape.

Factors determining “ease” include algorithm design (some being deliberately ASIC-resistant), network difficulty, and hardware requirements.

Bytecoin and Vertcoin accommodate consumer-grade equipment, while Ethereum Classic favors high-memory GPUs.

The cryptocurrency world has, rather pragmatically, created this tiered accessibility—ensuring mining remains viable across different technical and financial capabilities.