Few technological developments have managed to simultaneously revolutionize artificial intelligence capabilities while spawning an entirely new class of speculative digital assets—yet OpenAI’s GPT-5 launch appears poised to achieve precisely this unlikely feat.

The performance metrics alone suggest something approaching genuine technological breakthrough rather than incremental improvement masquerading as innovation. GPT-5’s 96.7% accuracy in telecom tool-calling and 94.6% performance on AIME 2025 mathematics problems represent quantum leaps over predecessor models—achievements that should theoretically translate into substantial market disruption across knowledge-intensive sectors.

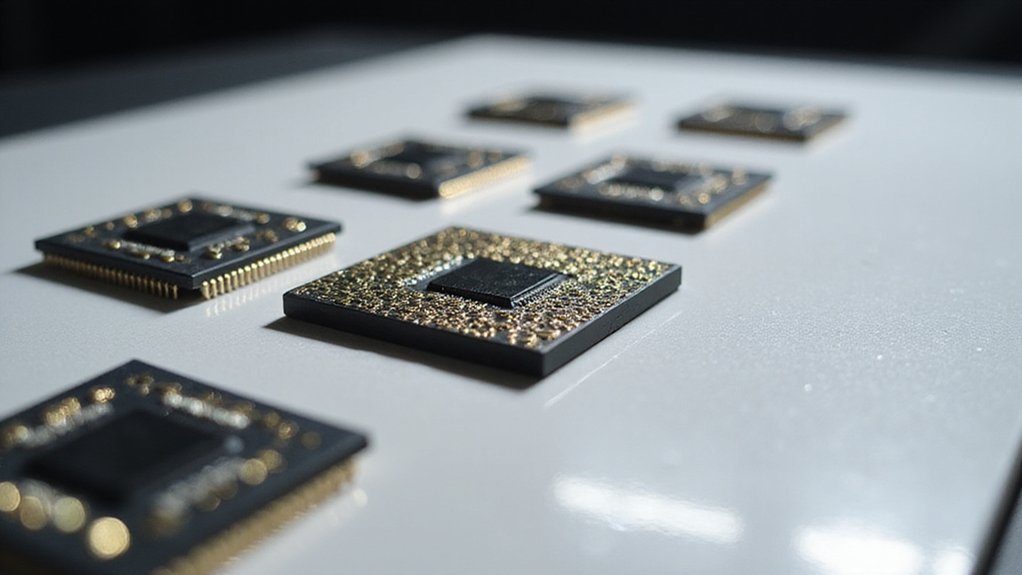

The model’s hybrid architecture, featuring different processing layers optimized for speed versus depth (alongside those curiously named “multi-personality layers” including cynic and robot modes), addresses longstanding enterprise concerns about reliability and customization. Users can now leverage a real-time router that automatically selects the most appropriate model configuration without manual intervention, streamlining deployment across diverse operational contexts.

Perhaps more compelling from an economic perspective, GPT-5’s hallucination rates have plummeted to under 1% on open prompts—a development that could finally enable widespread deployment in regulated industries like healthcare and finance. When reasoning mode reduces medical query errors to just 1.6%, one begins contemplating genuine automation of complex professional tasks rather than mere assistance tools.

The sub-1% hallucination threshold transforms GPT-5 from sophisticated assistant into viable automation platform for regulated professional environments.

Enter $Subbd tokens, which appear designed to capitalize on this convergence of enhanced AI capabilities and speculative fervor. These utility tokens ostensibly incentivize participation within AI-driven ecosystems, though the precise mechanics remain characteristically opaque—a feature, not bug, in contemporary tokenomics. The AI-token market has demonstrated explosive growth potential, transforming from a nascent sector into a multi-billion dollar ecosystem in remarkably short timeframes.

The investment thesis becomes intriguing when considering GPT-5’s 272,000-token input capacity and sophisticated API controls. Such specifications enable integration into enterprise workflows previously considered too complex for AI intervention, potentially creating substantial demand for tokens facilitating access to these capabilities. The model’s smart router automatically selects the most appropriate processing tier based on task complexity, optimizing both performance and computational costs.

Early positioning in both GPT-5 applications and $Subbd token accumulation represents a calculated wager on AI’s evolution from experimental technology to foundational infrastructure. The model’s demonstrated superiority in economically critical domains—law, engineering, logistics—suggests institutional adoption may accelerate beyond typical enterprise software cycles.

Whether this convergence produces unprecedented gains or merely unprecedented hype remains uncertain, though the underlying technological capabilities appear sufficiently robust to justify serious consideration from investors seeking exposure to AI’s practical commercialization rather than speculative bubble dynamics.