While the broader market grappled with uncertainty, crypto mining stocks experienced a remarkable surge in May 2025, propelled by a potent combination of rising Bitcoin prices and operational efficiencies that would make traditional energy companies envious. Mining revenue jumped nearly 20%, with North American operations commanding 26.3% of global activity—a concentration that would make OPEC members nod in recognition.

The numbers tell a story of operational excellence that extends beyond mere Bitcoin appreciation. CleanSpark (CLSK) delivered a staggering 120% year-over-year revenue increase, generating $241.7 million in net income for Q1 2025 while reducing their cost per mined coin by 6% to approximately $34,000. Such efficiency gains suggest these companies have moved beyond the boom-bust mentality that once characterized the sector.

Hyperscale Data exemplified this transformation, mining 17.4 Bitcoin to generate $1.9 million in May revenue—figures that underscore how operational scale translates directly to profitability. The company’s subsidiary, Sentinum, is expanding into Montana, part of a broader North American capacity buildout that signals confidence in sustained demand.

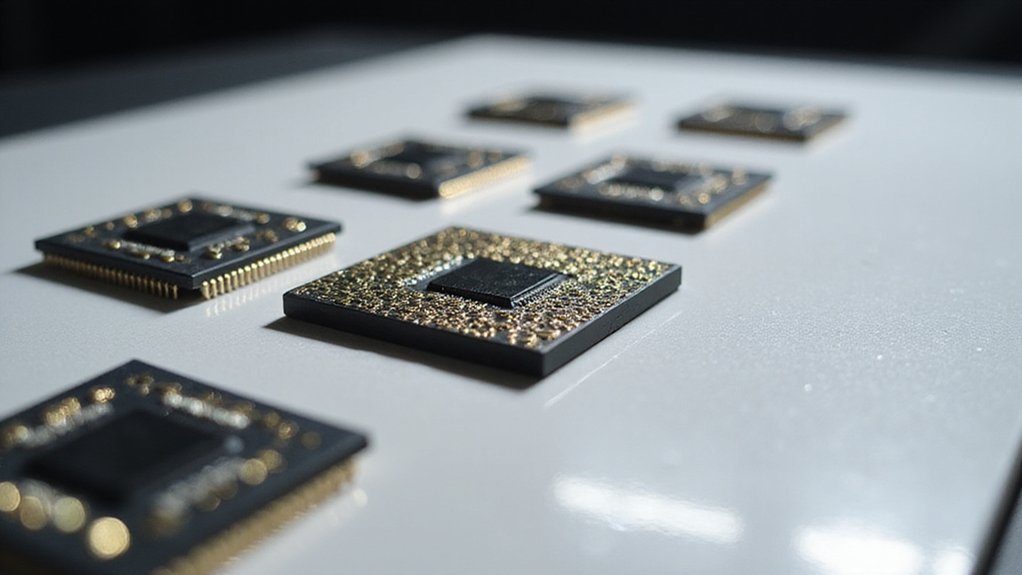

Cipher Mining’s ambitious expansion from 13.5 EH/s to a targeted 35 EH/s demonstrates the sector’s appetite for growth, leveraging advanced hardware like Canaan A1566 miners to optimize computational efficiency. These aren’t the speculative ventures of crypto’s early days; they’re industrial operations with renewable energy integration and sophisticated capital deployment strategies. Mining operations employ proof-of-work consensus mechanisms to validate transactions and add new blocks to the blockchain, with puzzle complexity adjusted regularly to maintain consistent block creation timing.

Market sentiment reflects this maturation. Investors increasingly differentiate between miners with diversified revenue streams and those anchored solely to Bitcoin’s volatility. Marathon Digital Holdings (MARA) and Riot Platforms (RIOT) have emerged as favorites, their scalable growth models and dividend potential attracting institutional attention previously reserved for traditional utilities. The regulatory oversight provided by these publicly traded companies offers enhanced transparency compared to direct cryptocurrency investments, appealing to risk-conscious institutional investors. However, the industry faces mounting pressure as the median direct cost of mining is expected to exceed $70,000 per BTC in Q2, reflecting the production costs surge across the sector.

The technical recovery in mining stocks—evidenced by CLSK retesting weekly resistance levels—suggests investors recognize the operational leverage these companies possess. When Bitcoin rises, mining margins expand exponentially, creating returns that often outpace the underlying cryptocurrency itself.

This geographic concentration in North America, combined with regulatory clarity and technological advancement, positions these miners not merely as Bitcoin proxies but as legitimate infrastructure plays in the digital economy’s expanding foundation.