While traditional cryptocurrency mining once required investors to transform their homes into miniature data centers—complete with industrial-grade cooling systems and the electrical consumption of small towns—cloud mining has emerged as the digital equivalent of hiring someone else to dig for gold while you collect the proceeds from your armchair.

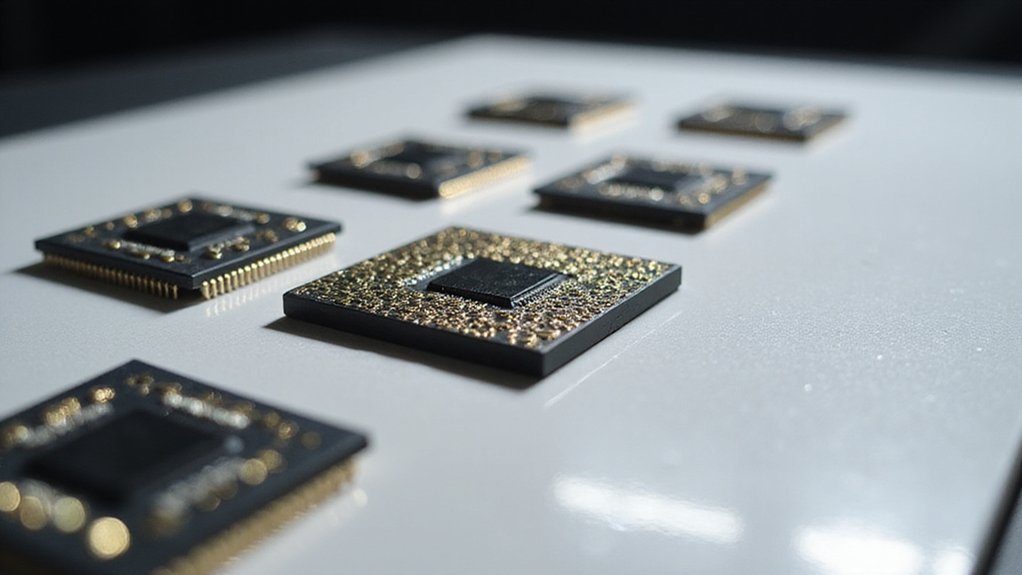

The mechanism operates with invigorating simplicity: specialized mining firms maintain vast data centers equipped with ASIC miners and GPU arrays, then lease hash power to investors who prefer their cryptocurrency extraction without the accompanying electrical fire hazards. Participants join mining pools where profits flow proportionally to their rented computational power, creating what amounts to a timeshare arrangement for the digital mining economy.

This democratization of mining access eliminates the traditional barriers that once relegated cryptocurrency mining to those with both technical expertise and neighbors tolerant of industrial-grade ventilation systems. Cloud mining providers handle the mundane realities of hardware maintenance, electricity costs, and the perpetual arms race of mining difficulty adjustments, while users simply select hash rate packages for specified durations.

The profitability proposition varies considerably depending on market conditions, mining difficulty, and provider fee structures. Some platforms advertise daily returns that would make traditional savings accounts weep with envy—though such promises warrant the usual skepticism reserved for financial propositions that seem too convenient to be entirely true. A $100 investment might generate $4 daily income plus contract expiration bonuses, though these figures fluctuate with crypto market volatility and mining complexity.

Leading platforms continue innovating with multi-cryptocurrency options spanning Bitcoin, Litecoin, and Dogecoin, while mobile applications provide streamlined access for investors who prefer their passive income generation to be genuinely passive. The underlying mining process involves generating cryptographic hashes to validate transactions and prevent double spending through network consensus mechanisms.

The irony, of course, lies in how cloud mining simultaneously democratizes access to cryptocurrency mining while centralizing the very computational power that blockchain networks were designed to distribute. Modern platforms serve millions of users across global networks, with some operations managing over 100 data centers while maintaining comprehensive regulatory compliance and security protocols.

The sector’s evolution reflects broader trends in financial technology: complex processes becoming accessible through user-friendly interfaces, though investors must navigate potential hidden fees, market volatility, and the ever-present specter of less-than-transparent contract terms that characterize emerging digital financial services. Periodic halving events systematically reduce block rewards over time, adding another layer of complexity to long-term mining profitability calculations.