Legitimate Bitcoin acquisition methods span various commitment levels and technical proficiencies. Mining—once accessible—now requires specialized hardware, while cloud services like ICOMiner offer entry points for the ASIC-averse. Affiliate programs leverage marketing skills for satoshi commissions without capital outlay. Faucets distribute microamounts for completing menial tasks. Interest-bearing accounts generate passive income from existing holdings. Educational pathways, including learn-to-earn programs, reward cryptocurrency knowledge acquisition. These methods, ranging from trivial to substantial, await exploration beyond this cursory overview.

Why chase traditional assets when digital gold beckons?

Bitcoin, that peculiar amalgamation of cryptography and financial revolution, offers myriad pathways to acquisition beyond the conventional purchase routes.

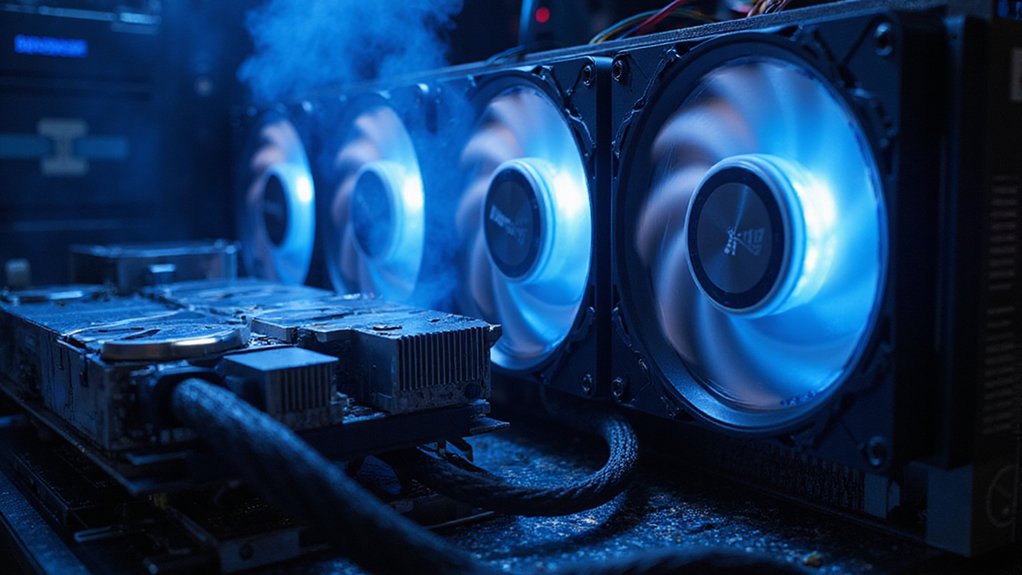

While mining represents the primordial method of Bitcoin procurement—lending computational resources to verify blockchain transactions in exchange for newly minted tokens—this approach has evolved considerably since Bitcoin’s nascency.

The days of profitable mining via standard computing equipment have largely vanished into the ether of technological progress, replaced by specialized ASIC hardware and substantial electricity investments.

Nevertheless, mobile applications like FioBit now provide accessible, if modest, mining opportunities for the hardware-averse enthusiast.

For those disinclined toward the technical rigors of mining, affiliate programs present an alternative revenue stream.

By promoting Bitcoin-related services through referral links, one can accumulate commissions denominated in satoshis¹ without investing capital—though success demands marketing acumen and audience cultivation.

Similarly, Bitcoin faucets distribute microamounts of cryptocurrency for completing mundane online tasks (captchas, advertisements, surveys), offering minimal yet entirely free Bitcoin infusions at regular intervals.

The financially prudent might consider staking or interest-bearing accounts—not strictly “free” methods, as they require existing Bitcoin holdings, but they generate passive income through compounding mechanisms. Some platforms enable users to contribute to network stability while earning reasonably predictable rewards with relatively low risk compared to other crypto earning strategies.

These platforms basically leverage one’s dormant crypto assets to support network operations, returning a percentage yield that fluctuates with market conditions.

Perhaps most intriguing for the neophyte are the educational pathways to Bitcoin acquisition.

Learn-to-earn programs reward users with fractional Bitcoin for completing educational modules about blockchain technology, while airdrops distribute tokens to participants in emerging projects. Several exchanges like Coinbase and Binance offer these educational opportunities where watching videos and completing quizzes can earn you free cryptocurrency.

Cloud mining services further democratize the mining process, allowing individuals to rent hashpower² without maintaining physical hardware—with platforms like ICOMiner offering trial periods for the uninitiated.

¹The smallest unit of Bitcoin, equivalent to 0.00000001 BTC.

²Computing power dedicated to mining operations.

Frequently Asked Questions

Are Bitcoin Winnings Taxable Income?

Yes, Bitcoin winnings absolutely constitute taxable income.

The IRS definitively classifies cryptocurrencies as property—subject to capital gains rules when sold and ordinary income rules when received as payment, prizes, or mining rewards.

Fair market value at receipt establishes the taxable amount, while the holding period determines whether gains qualify for preferential long-term rates.

Documentation is essential, as the tax authorities’ blockchain visibility continues to improve, rendering the “what happens in crypto stays in crypto” mentality increasingly antiquated.

How Quickly Can I Earn a Significant Amount of Bitcoin?

The timeline for acquiring substantial Bitcoin varies dramatically across methods.

Trading can yield quick returns (hours to days) but carries commensurate risk.

Mining, once lucrative for individuals, now favors institutional players with specialized equipment.

Passive income strategies—staking, interest accounts, yield farming—generate slow but steady accumulation.

Affiliate marketing builds gradually over months.

The uncomfortable reality? Significant Bitcoin acquisition generally follows the timeless financial principle: substantial returns require either substantial capital, substantial risk, or substantial patience.

What Are the Risks of Participating in Bitcoin Giveaways?

Bitcoin giveaway risks range from the obvious to the insidious.

Participants face data compromise, wallet vulnerabilities, and identity theft—the unholy trinity of digital security nightmares.

Scammers employ impersonation tactics and artificial urgency to extract sensitive information, often leaving victims unaware until their assets mysteriously vanish.

Beyond individual losses, these schemes erode market confidence and community trust.

The prudent investor approaches “free Bitcoin” with the same skepticism reserved for Nigerian princes offering unexpected inheritances.

Can I Win Bitcoin Using Mobile Devices Only?

Yes, mobile-exclusive Bitcoin acquisition is entirely feasible.

Numerous apps facilitate cryptocurrency earnings through various mechanisms: gaming applications like Bitcoin Blast and Sweet Bitcoin reward puzzle-solving; survey platforms such as Cointiply and FreeCash offer compensation for opinion-sharing; educational platforms including BitDegree dispense BTC for completing learning modules.

Mobile faucets, referral programs, and gamified tasks constitute additional pathways.

The yields—predictably modest—require minimal investment beyond one’s time and attention, making them accessible entry points into cryptocurrency accumulation.

Which Method Has the Highest Return on Time Invested?

Yield farming typically offers the highest return on time invested, with its potential for astronomical APYs (sometimes reaching triple digits—a phenomenon that would make traditional bankers apoplectic). However, this comes with commensurately elevated risk profiles.

Arbitrage presents another compelling option, particularly for those with algorithmic trading capabilities.

Mining, despite its historical prominence, has become increasingly time-inefficient for individual participants, while staking and lending represent more passive—albeit less lucrative—alternatives for the risk-averse investor.